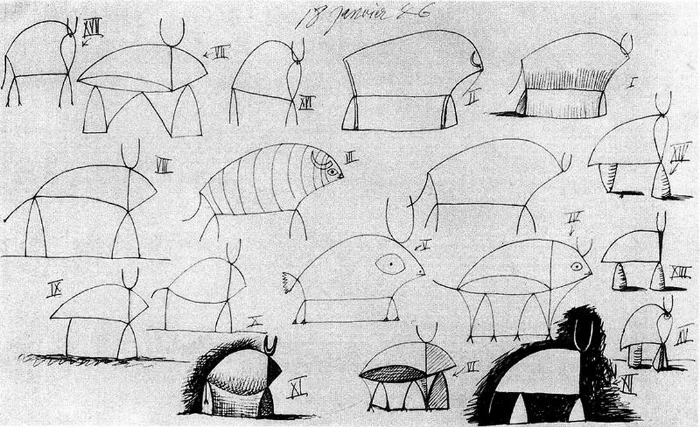

Bulls on Parade

Over the last several years, "disruption" has become both a buzzword and a bogeyman in a whole range of industries. The fine art space has been no exception. And while outside analysts have tended to be the most enthusiastic about its imminent potential, some insiders have fallen under the spell, too.

Today I want to try to correct some potential misunderstandings about just how much industry-changing chaos has actually taken place, hopefully before those misunderstandings start to distort anyone's expectations of where we are. And I'm going to use an insider opinion as my on-ramp.

In the introduction to his interview with the founder of ARTA, the startup aspiring to be "the Kayak of art shipping," Artspace editor-in-chief Andrew M. Goldstein wrote the following this Wednesday:

Remember when it used to be considered a bad thing to "disrupt" something? For a very long time this was certainly the case in the art world, where genteel manners, discretion, and personal ties were the hallmarks of success. Now, however, we live in a vastly different moment, when every aspect of that traditional gallery model––from selling art to representing artists to fabricating works––has been disrupted by online upstarts that promise to use digital technology to eliminate gross inefficiencies in the market (and make a tidy bundle in the process).

Now, I like and respect Goldstein's work. And I don't want to blow out of proportion three sentences he used used to set up a Q+A with someone who I believe has a legitimate shot at re-ordering a sector of the market, however unglamorous that sector may be.

At the same time, I think Goldstein's lede includes a serious misrepresentation of the state of the fine art union. The reality is that very little of the traditional gallery model has been disrupted by anyone at this point––not if we follow the definition given by Clayton Christensen, the man who coined the term "disruptive innovation" in the first place.

According to the Key Concepts section of Christensen's site, disruptive innovation "describes a process by which a product or services takes root initially in simple applications at the bottom of a market and then relentlessly moves up market, eventually displacing established competitors."

By Christensen's definition then, declaring that "every aspect of that traditional gallery model... has been disrupted" means declaring that established competitors have already been beaten at their own game by younger, more innovative rivals, even at the top of the art market food chain. And that just isn't the case.

Yes, it's true that middle-tier galleries are an endangered species, as I've written before. But their peril has at least as much, if not more, to do with the crushing downward pressure from blue chip and mega-galleries as with any technology-based initiatives firing up through the floorboards. And no matter how effective, say, direct artist-to-consumer sales platforms may be, they're nowhere near to scaring the Gagosians, Paces, and Zwirners of the world into hiding under the covers with flashlights and rosaries.

The data backs up this reality check. The 2015 Hiscox Online Art Trade Report concluded that online art sales last year totaled about $4B. The most recent TEFAF Art Market Report basically agreed, setting the same figure at about $3.75B. However, the TEFAF study also pegged cumulative sales for the entire industry––online and offline––at about $58B over the same period. This means e-commerce accounted for only about six percent of overall market share. And for our current purposes, we even have to caveat that conclusion, because all of the figures above mix the auction and gallery sectors together in one big, simmering witch's cauldron.

More importantly, though, the Hiscox report found that 84 percent of online buyers used e-commerce to acquire works priced at less than about $15,000, and 41 percent of that sample acquired works priced at less than about $1,500. So to paraphrase Jules Winnfield [NSFW], right now the high and low ends of the gallery market ain't the same ballpark, ain't the same league, ain't even the same sport. To suggest otherwise is to render a flawed image of the landscape for artists and collectors at every level.

I like ARTA's promise in the packing, crating, and shipping niche even in the near term. And there are other startups with some potential to pilfer market share in other sectors of the fine art industry... eventually. But for now, my advice is to stay skeptical of the disruption bulls when they charge into the gallery sector. Because, to invoke another Silicon Valley favorite, being early is as bad as being wrong.