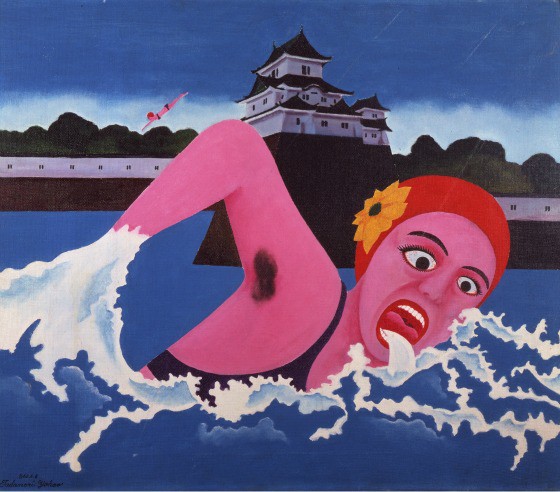

Bay Watch

From Chelsea to the Los Angeles Arts District, the past few years have seen a rising wave of real estate costs push sub-blue chip galleries out of key neighborhoods in art capitals on both American coasts. But with evidence now mounting that the Bay Area is (finally) enticing high-end out-of-town dealers to dive in, could the real-estate market there actually get turbulent enough to wash lower-tier galleries away from the entire city of San Francisco, if not the whole region?

It might sound ridiculous at first. But consider the following...

In the past month, Pace announced that it will trade its long-running Menlo Park pop-up space for a permanent location in Palo Alto; Gagosian staked its claim on a 16th location steps away from the refreshed and expanded SFMOMA, with John Berggruen upgrading to a new space next door; and just a few days ago, high-end New York mainstays Anton Kern and Andrew Kreps accepted an invitation from SF alternative art complex The Minnesota Street Project to open a temporary joint space in the city.

Meanwhile, real-estate prices in the Bay Area have risen to levels that should qualify for admission to a psychiatric hospital. Two years ago, respected San Francisco galleries were already being booted from their longtime homes by tech companies willing to pay multiples of their rent. Two months ago, Forbes reported that the average San Francisco home price stood at $1.45 million, and that the city's overall housing prices ranged from "about 25 to 60 percent above what the fundamentals of the US economy can justify." And yesterday, news broke that Palo Alto's city council had voted to investigate a "proposal that would essentially subsidize new housing for what qualifies as middle-class nowadays, families making from $150,000 to $250,000 a year."

Blend all of the above together, drink it down, and let me ask again: Is it ridiculous to imagine a Bay Area so awash in cash that only the bluest of the blue-chip galleries can stay afloat there?

For the sake of a diverse and semi-organic northern California arts scene, I hope the answer is "yes." Ultimately, I expect it is. Almost no trend lasts forever. Bubbles burst. Cities and regions evolve. People adapt.

But given the 21st century's troubling wage and productivity realities, very little seems too extreme for me to completely rule out when it comes to financial inequality––especially when either Silicon Valley or the art industry enters the picture. Put those two forces together, and I can imagine almost any monstrosity rising out of the Bay.

So yes, this may all be a false alarm. But even if the region avoids an absolutely dystopian future, its local and less brand-heavy galleries may still need all the help they can get to survive. Keep your binoculars and flotation devices ready.