Why Beeple’s 'Everydays' Could Be the $69.3 Million Key to Lucrative Venture Capital Investments

This week, finding a way in through the out door…

META-ANALYSIS

On Friday, Stefania Palma broke virtual bread with crypto-mogul Vignesh Sundaresan (AKA Metakovan) for the Financial Times’s “Lunch with the FT” series. The conversation surfaced noteworthy parallels between venture investing and the art market, including a new explanation for Sundaresan’s willingness to pay $69.3 million for Beeple’s Everydays: The First 5,000 Days. It now sounds like his big bid was partly just a means to a greater socioeconomic end—another indicator that the penthouse level of the crypto-art trade is mostly mirroring that of the traditional art trade.

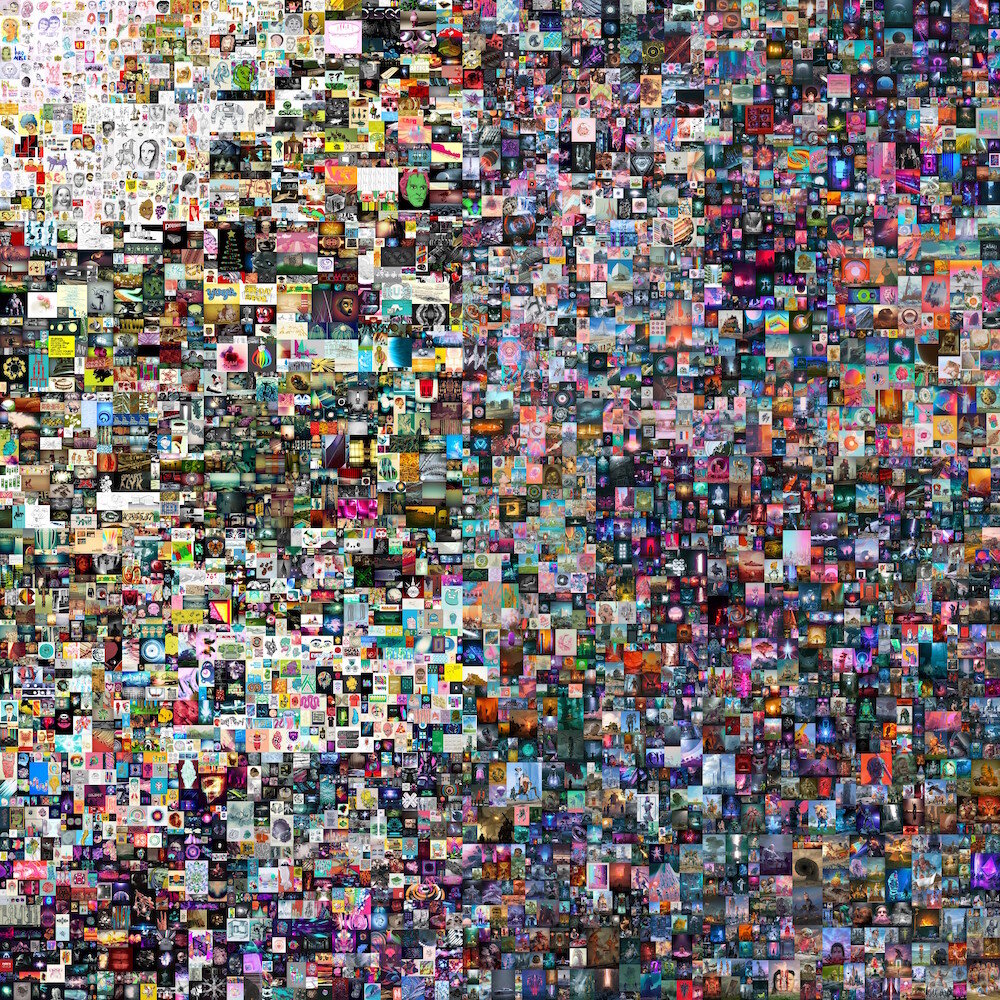

To refresh everyone’s memory in this madcap year, Christie’s originally identified the winning bidder for Beeple’s magnum opus (which was marketed as the first "purely digital work with a unique NFT" ever sold by a major auction house) only as Metakovan, a pseudonymous Singapore-based blockchain entrepreneur behind the combination crypto-investment fund and NFT collection Metapurse. Through his equally mystery-shrouded associate Twobadour, Metakovan communicated to my colleague Eileen Kinsella that he had acquired Everydays because it “has the potential to be the work of art of this generation,” and that he also planned to build a “massive monument” to the piece in virtual space so he could “open it up to the world.”

But the smooth tracks of the narrative got crimped the week after the historic auction.

First, crypto-sleuth Amy Castor laid out a convincing case that Metakovan and Twobadour were none other than Sundaresan and his longtime communications rep, Anand Venkateswaran—and that the duo was already in business with Beeple prior to the Christie’s auction. Beeple, she noted, owned two percent of the B.20 cryptocurrency Metapurse had used to tokenize ownership of its NFT collection, whose centerpiece is a set of 20 of the artist’s works acquired for $2.2 million on Nifty Gateway last year. (Everydays: The First 5,000 Days is not currently part of the B.20 collection, and Sundaresan does not plan to monetize the record-setting work “yet,” according to an email to the New York Times in March.)

Then my colleague Ben Davis excavated a slew of undeniably problematic content buried inside the 5,000 images making up the digital collage of Everydays. His discoveries added momentum to one of the most propulsive criticisms of the Beeple sale: that it was just the gaudiest emblem of a retrograde, white crypto-bro attitude dominating the NFT market and big tech more broadly.

But the day after Ben’s piece went live, Metakovan and Twobadour published a surprise blog post confirming their away-from-the-keyboard identities and announcing that they had bought the Beeple as a way “to show Indians and people of color that they too could be patrons, that crypto was an equalizing power between the West and the Rest, and that the global south was rising.” (Somewhere in the annals of prestige television, Don Draper applauded the reversal.)

All of which leads us to the FT interview. There, Sundaresan expounded on a point alluded to in the narrative-shifting blog post I just mentioned: that crypto ventures comprise a more democratic, meritocratic ecosystem than standard investing and entrepreneurship.

When Palma asked whether he believed “financial markets are steeped in fundamentally imperialist structures,” Sundresan rallied behind the idea, implying that he has been excluded from multiple investing opportunities because of his cultural heritage, lack of connection to Silicon Valley’s favored U.S. universities (primarily Stanford), and the assumption that his network would be less valuable to a startup’s founders than those of other potential early-stage backers.

This line of reasoning leads to the key passage concerning the $69.3 million Sundaresan paid for Everydays:

“Once I understand this, I go around it. Now, why will I become Metakovan? Why will I buy Beeple? Because of all of this. Now everyone wants me in the cap table,” he says, referring to the spreadsheet of investors commonly used by start-ups. “That’s how much I have to do, this circus stunt, to be part of cap tables because that’s the kind of people they want in the cap table.” Sundaresan mimes avoiding obstacles with his hands. “It’s historic . . . we cannot change that. We just have to figure out ways to bypass that.”

There’s a lot happening in that excerpt, but I think two of its notes resonate especially loudly here in the art industry.

DETOURS AND ON-RAMPS

First, let’s examine Sundaresan’s rhetorical question, “Why will I become Metakovan?” His subtext here is that cloaking himself in a pseudonymous identity has been more valuable than transparency in an industry where biography is too often destiny. Better to exist as an avatar than a specific person. That way, you can be evaluated on your professional accomplishments rather than penalized for the gap between your background and the profile of the preferred startup investor.

What is that profile? For a starting point, look no further than the headline of the December 2020 WIRED piece “Yet Another Year of Venture Capital Being Really White.” Educational and gender myopia shape the field, too. Richard Kerby of Equal Ventures relayed data estimating that up to 40 percent of venture capitalists were alums of Harvard, Princeton, Stanford, or Yale in 2018—and that up to 82 percent were men. No wonder Monique Villa, a VC at Nashville’s Mucker Capital, described the state of play as follows in a May 2019 TechCrunch op-ed:

Venture has operated in many ways like a club since its inception, where deals are shared within small, private circles, often comprised of people with more in common than not. When investment decisions are made by people who are not representative of our population—instead representative of the interests of a very small percentage of the population (in ethnicity, culture, education, and socioeconomic status)—our economy suffers.

These race, gender, and social dynamics should sound familiar to art-industry participants, particularly when it comes to the primary market. The gallery sector operates as what economists call a “matching market”: one in which the buyer and seller must mutually select one another in order for a deal to get done. Just as it’s not enough for an investor with the appropriate capital to want to fund an in-demand startup, it’s not enough for a collector with the appropriate capital to want to buy the work of an in-demand artist from a dealer. In each case, the people in control of the asset decide whose money to accept based on whatever subjective criteria they see fit.

Most often, a buyer’s reputation and social network play outsized roles in that choice. This can manifest in ways that seem perverse, comical, or both to the outside world. Nothing more consistently gets non-art people to look at me like a psych-ward escapee than when I tell them the average dealer would much rather sell a painting to a museum trustee for $50,000 than to a first-time buyer with no art-world credentials for $75,000. But because of the trustee’s potential value as an evangelist among other collectors (as well as a herd-mentality selling point for the gallery), it’s usually the truth.

Still, reputations can be built in all kinds of ways, which leads us to Sundaresan’s second rhetorical question in the quote above: “Why will I buy Beeple?”

Mentioned in the context of “bypassing” historical systems to secure invitations to hot startup investor pools, the comment implies his decision to acquire Everydays had at least as much to do with his venture-capital ambitions as it did with his personal taste, interest in democratizing access to digital art, or even a lust for bragging rights. In the plainest terms, Sundaresan suggested that he thinks the purchase can get him a seat at cap tables that weren’t so interested in his money or connections before.

To be clear, I don’t think there’s anything scandalous about the man dropping his $69.3 million spending bomb for combined art and business reasons. In fact, I'd argue it could be a savvy maneuver. It's also one that has been deployed practically every day (ugh, no pun intended) in the art and collectibles markets for a very long time. New Yorkers have the Frick Collection today because its founder, the industrial tycoon Henry Clay Frick, decided that his relocation to the city in 1905 demanded that he begin collecting paintings that “reflected the high society into which he was moving,” according to his biographer.

It’s not a stretch to surmise from this explanation that Frick saw a connection between apex-level art buys and the trajectory of his business empire. From Wall Street to Hollywood (and beyond), countless non-art deals have taken root at gallery dinners, museum galas, and art-fair receptions, too. It’s more about art’s ability to become a shared patois between elites than it is about monetizing the art itself. The same is true for timepieces, classic cars, sports memorabilia, and other collectibles. Whenever movers and shakers speak the same dialect, all kinds of tantalizing propositions can arise.

Will Sundaresan’s gambit pay off in the early-stage investing space? Connie Loizos, the Silicon Valley editor at TechCrunch and founder of the daily venture-capital newsletter StrictlyVC, told me that she thinks the answer may depend on his ability to flip Everydays for a big gain.

“I do think if he manages to sell it for substantially more than he paid, he'll look like a genius, and, I'm guessing, encounter a lot of open arms," she said. "Otherwise, people will still take his money, but I'm not sure that includes the very best founders, who have their choice of backers and would prefer investors with a proven track record (and the halo effect they enjoy from that brand association)."

Whether Sundaresan is successful or not, though, his lunchtime chat with Palma conveys that, to some extent, he’s just deploying a familiar business strategy via a new type of collectible. His rhetoric also renders the $69.3 million Everydays purchase as another instance where the crypto-art trade is mimicking the traditional art trade, not upending it.

Like so much else in art, business, and life, the prospect isn’t shocking, but it doesn’t have to be in order to be worth heeding.

That’s all for this week. ‘Til next time, remember: the more things change, the more they stay the same.