Two Buzzy Hybrid Projects Have a Lot to Teach Us About the Uneasy Merger Between Crypto and Physical Art

This week, from recent events to possible futures…

UNITERS, NOT DIVIDERS

September 2022 has been shaping up to be a milestone for fusions in and around the art world. The month started off with the international art business converging on South Korea for the inaugural Frieze Seoul. This week is expected to welcome the so-called Ethereum Merge, which will have a major impact on the mechanics of the NFT market. And Armory Week festivities in New York last week included multiple events that sought to bridge the divide between the art establishment and the crypto space, with artists and intermediaries from different generations all manning metaphorical construction equipment.

So does this mean we’re meaningfully closer to the full integration of the physical and NFT art worlds? I’m not so sure about that after taking a firsthand look. In fact, I think last week’s events are most important as a reminder to stay wary of any totalizing narrative about art and technology, even as select artists, institutions, and collectors stake out interesting territory in the borderlands between them.

Among people familiar with the state of the cryptocurrency and NFT markets, it might seem like a grim time for artists to tap into these projects. Bitcoin and Ether were each down more than 56 percent YTD as of the morning before this column was published. One recent analysis alleged that trading volume on OpenSea had plunged more than 90 percent since January (though OpenSea disputed the methodology and the findings it produced); another study concluded that, across platforms, June was the weakest month of NFT sales in the preceding year.

The broader context makes it feel unjustifiably loaded that the two IRL NFT happenings I managed to check out were both one-night-only affairs. The first was the exhibition of artist and Quantum Art founder Justin Aversano’s “Cognition” works, 365 free-associative paintings from 2014–15 that he later minted and sold as one-of-one NFTs. Held at Venus Over Manhattan’s nascent downtown space at 55 Great Jones Street, the event doubled as an opportunity for “Cognition” NFT owners to pick up their corresponding paintings free of charge.

The second event was the unveiling of “Geometries,” a series of 22 editioned NFTs by canonical postwar abstractionist Frank Stella, at the artist’s former studio in the East Village. The project inaugurated Arsnl, the in-house NFT platform created by the Artists Rights Society—a concept that would have sounded hallucinatory to me in February 2021, if not even more recently.

Personally, I wasn’t expecting to find much more than superficial parallels between these two pop-ups. And yet, the more I’ve thought about both, the clearer it’s become that Aversano and Stella have landed on at least two pieces of common ground along the digital-to-physical continuum: one conceptual, the other social and historical. Given the significant differences between the two artists in age, audience, and approach, their points of convergence feel meaningful as I try to parse viable outcomes from dead ends in the relationship between the traditional and tokenized art worlds.

Below is a brief case study of each event, followed by a few thoughts to bring them together.

FRANK STELLA’S “GEOMETRIES”

Background: Arsnl originally planned the Stella NFT drop in June but postponed it based on the dour market conditions, according to founder and CEO (and, disclosure, fellow Artnet News columnist) Katarina Feder. So far, the move looks shrewd: Arsnl sold out all editions of the 20 works made available for $500 apiece in the private presale, according to a Tuesday update on its website. (The public sale is tentatively slated for after the Ethereum Merge, assuming it happens as expected this week; prices for the remaining editions will be $1,000 each.)

Full sets of Stella’s “Geometries” have already been acquired by a buyer base “split between ‘crypto whale’ collectors, a couple of crypto artists themselves, and some of Frank’s oldest collectors, some of whom needed help setting up their [crypto] wallet,” Feder said by phone Monday afternoon. A major American museum bought a set, too, but the latter’s identity remains under wraps for now.

The Physical-to-Digital Connection: What most perked up my ears about the “Geometries” series was Stella’s apparent intent to tether them to the tangible world. Owners of each NFT have the right to 3D print the corresponding form at almost any scale, in almost any available material or color, as many times as they want. The launch event included live demos of the process courtesy of 3D printmaker Creality, as well as finished print-outs suspended from the ceiling and displayed on modest plinths. (Despite the optionality, the models on view seemed to indicate that the artist prefers white, black, or gray outputs.)

How to think through this wrinkle? Technically, the 3D prints are not actual Frank Stella works but rather derivative “models after the work” of Stella, Feder said. They are also explicitly not for commercial use. In theory, then, they should not be worth much of anything beyond the cost of printing.

At the same time, the 3D-printed models don’t just share a bond with the NFTs. Together, both aspects of the “Geometries” share a bond with Stella’s practice dating back to at least the 1990s, when the artist first began using software to design the increasingly complex forms of his increasingly sculptural works. (A commissioned essay by crypto sage and entrepreneur Jason Bailey draws out the connections further.)

The Social-Historical Connection: The continuity with Stella’s decades-long practice is only strengthened by the decision to stage the launch event at 126 East 13th Street. Now leased by the Peridance Center, a multi-genre dance studio, the building was his artistic headquarters from 1978 through 2005, a tenure that earned the building protection (and a plaque) from NYC’s Landmarks Preservation Committee.

JUSTIN AVERSANO’S “COGNITION” EXHIBITION

Background: Aversano’s approach to the “Cognition” works was to some extent the inverse of Stella’s approach to “Geometries.” The series began as a one-canvas-per-day painting project in the aftermath of his mother’s death in 2014, then became an NFT series more than seven years after the final painting’s completion. Aversano quickly sold out the “Cognition” NFTs for 1 ETH each this August (about $1,600 at the time). Last week’s pop-up gave NFT buyers the chance to pick up the physical analogue of the tokenized work at no extra cost.

The Physical-to-Digital Connection: When I asked Aversano why he decided to mint and sell the 365 “Cognition” canvases after such a long delay, he said that the relationship between physical and tokenized works was a conceptual one, just as it is with each of his four main projects so far.

“The beauty of NFTs is that they’re permanent. The physical dies or degrades, whereas the digital twin gets better over time on the blockchain. They meet in the middle and then go their separate ways. It’s death and life, which is what my whole practice is based in,” he said. “I’m a Libra, so it’s the scales.”

In the case of the “Cognition” paintings, Aversano saw the Venus Over Manhattan exhibition/giveaway partly as a cathartic act—a way to let go of objects he had begun to obsess over. “It was better to release this creative energy to collectors so people can connect or relate to the work,” he said. “It liberated me by having this show. I needed that. More than selling out, it’s just giving out this work that’s a true success.”

In contrast, it was important that he keep the full set of 100 chromogenic prints comprising his physical “Twin Flames” series intact even as he minted and sold the NFTs of each work individually, because he hopes to one day show them together “as a family” at a major museum. That was why he held back the print set to be sold as a package with the NFT for the cover image (Twin Flames #83. Bahareh & Farzaneh) at Christie’s last October. Conceptually, he called this arrangement “the perfect antidote for the web2/web3 weave.” The lot sold for $1.1 million, more than 10 times its $100,000 low estimate.

(Aversano’s other two main projects to date are still waiting for the resolution of their digital and physical aspects. He said that he will mint “Every Day Is a Gift,” the Polaroid series in which he captured a different birthday party every day for a year, on Quantum next year. He is already working with another unnamed gallery—“not Venus”—on the next step in his “Smoke and Mirrors” series.)

The Social-Historical Connection: Beyond the emotional redistribution aspect, Aversano portrayed the one-night-only event as a way to unite a mainly digital audience in a tangible space, all for the sake of strengthening social bonds: “The whole point was about building community online and offline, connecting to physical art, and not just making crypto an ethereal thing. I don’t believe in just sitting on computers or on Twitter Spaces. That’s not where we want to end up.”

Only time will tell if deeper bonds took hold, but plenty of NFT owners at least accepted the invitation to join up. Aversano estimated that more than 265 of the paintings were claimed by the end of the night, with the gallery offering to ship the rest to their rightful owners.

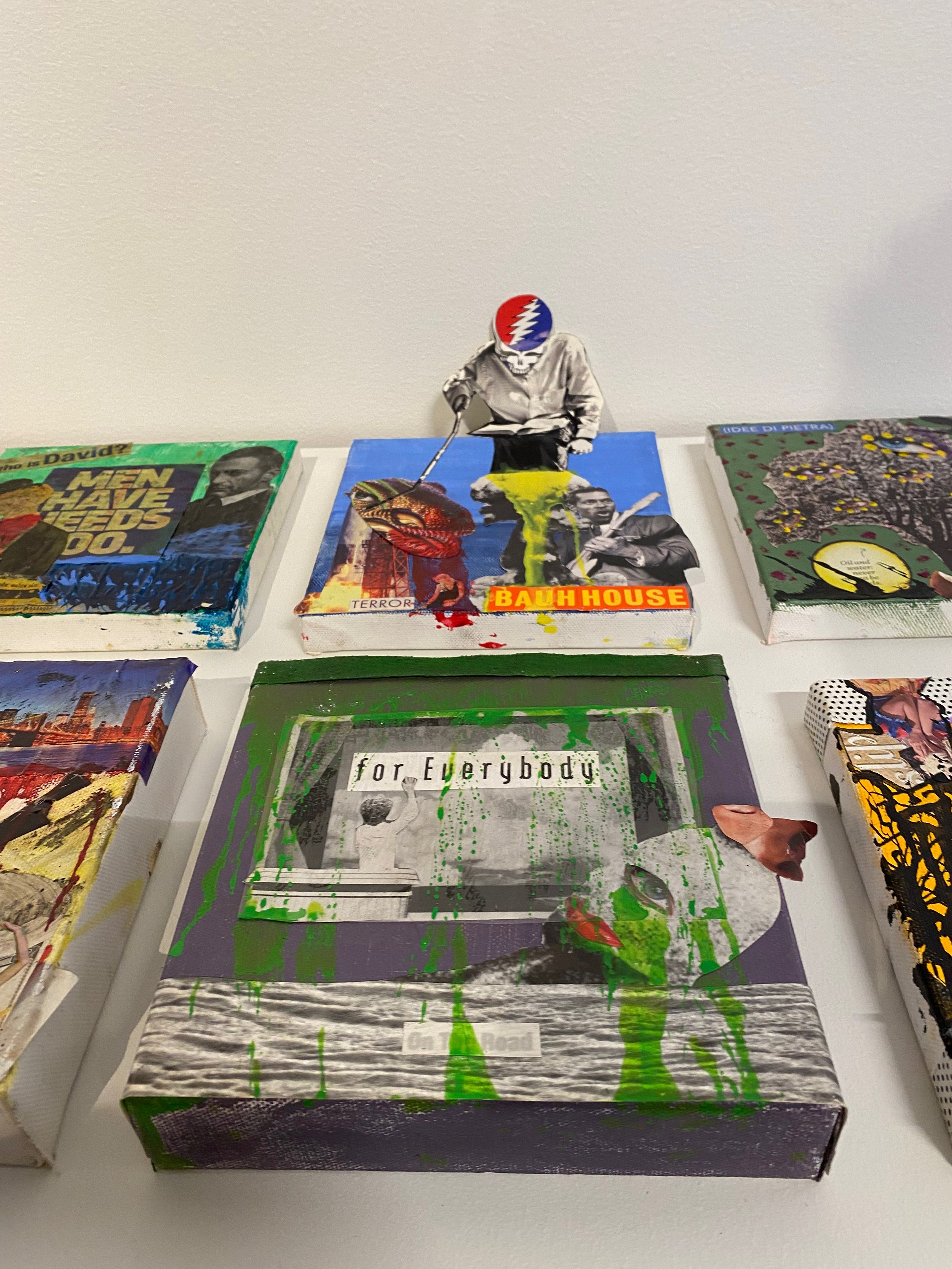

As with Stella’s “Geometries” launch, physical location played an important role in the “Cognition” pop-up, too. Venus Over Manhattan’s downtown space stands next door to a carriage house once owned by Andy Warhol and used as Jean-Michel Basquiat’s studio. Along with Venus founder Adam Lindemann’s personal connection to Basquiat, Aversano saw the site as a way to tie an art-historical loop enclosing two different generations of “free-expression and collage artists” who came out of the greater Brooklyn scene.

TOGETHER, FOREVER?

The drumbeat for total convergence between the physical and crypto art worlds has gotten a little bit louder almost every day since the Sale That Shall Not Be Named in March 2021. The drummers themselves are also pounding away from up and down the hierarchy. For instance, Sotheby’s CEO Charles Stewart had this to say on the matter in a Wall Street Journal profile earlier this year:

I also think there’s so much yet to be unlocked in terms of blockchain usage, and the day will come when the physical art we sell will somehow be recorded and supported by a token on the blockchain. It’ll be the standard because it has the potential to solve a number of long-standing issues around things like title, authenticity and provenance. It took the rise of NFT art to raise our own collective awareness to these possibilities.

I’ve talked to artists who feel this way too. Although some take this view for similarly practical reasons (such as potential improvements in provenance records and the prospect of recouping resale royalties), others do so because of a belief that we’re hurtling toward an all-encompassing, blockchain-powered metaverse where only artworks with a corresponding NFT will be able to port over to the immersive virtual life to come.

But when I asked Michael Connor, the newly appointed co-executive director of Rhizome, about his stance on the prospects of a grand physical-to-digital art singularity through the blockchain, he was circumspect. “These technologies do have a place. The problem emerges when there’s a singular narrative rehearsed about them,” he said.

To Connor, key arguments between absolutists on both sides of the crypto-versus-physical-art divide today tend to rehash arguments between absolutists in the equivalent camps during the early days of the internet decades ago: basically, each side believes its preference follows from inviolable laws that the other’s must kneel to for legitimacy, when in reality the most compelling outcomes arise from people able to recognize the unique traits of analog and digital space, then toggle between them.

“Projects like the Stella drop last week are trying to show that there can be a hybrid approach, where there’s a relationship between these cryptographically authenticated networks and what happens in the physical world,” he said. “The project kind of made a case for the blockchain not being a super exceptional space from everyday life but instead being integrated in different ways.”

Personally, last week’s festivities reinforce my skepticism of the totalizing storylines, too. Say what you will about the individual merits of Stella’s “Geometries” and Aversano’s “Cognition” projects, but their grounding in artist-specific concepts and site-specific socializing feel important to me—not because the people involved believe their preferences are right for everyone, but because they suggest that it’s okay for different artists, organizations, and collectors to prioritize different things.

So, does every painter, sculptor, and estate need to start minting NFTs? Not necessarily, if it doesn’t align with their practice or their values. Likewise, is IRL community absolutely necessary to advancing and enjoying born-digital art? I don’t think so, but it often helps.

Where does this leave us? Connor put it better than I could.

“Rather than making predictions, I’d rather state a wish. It’s not my wish that every artwork has a tokenized aspect for the reason that that doesn’t sound particularly desirable. People should be cautious about treating these narratives as inevitabilities. They should allow some space for their own hopes and dreams.”

That’s all for this week. ‘Til next time, remember: the more convinced someone is of their own vision of the future, the more important it is to ask what they have to gain from it.