Putting the 'Bargain' in "Grand Bargain"

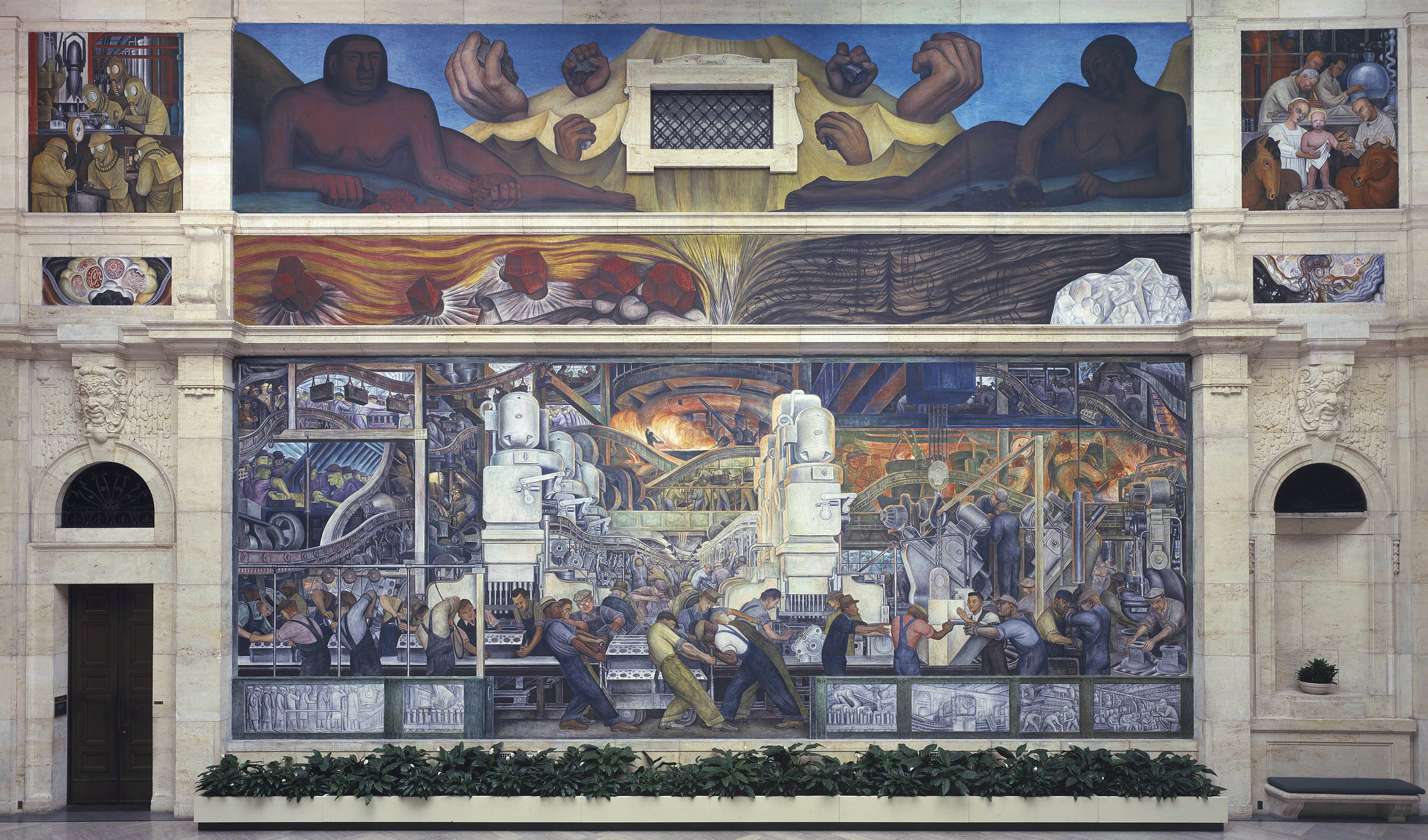

Only a few months ago, the art world was bracing itself for the likelihood that the Detroit Institute of Arts might be forced to deaccession a chunk of its permanent collection to raise funds for its host city’s bankruptcy recovery plan. But the winds have shifted dramatically since then. First the judge presiding over the case raised doubts about the legality of this unorthodox debt settlement method. Then came a proposal for the museum to buy itself out of city control - and thus permanently destroy any jurisdiction Detroit’s creditors might claim to its collection - in exchange for a $100M contribution to the rescue fund. Now both Detroit’s emergency manager and the mediator in the case have endorsed that proposal as a part of an $815M grand bargain to settle the bankruptcy once and for all.

As Detroit Free Press staff writer Mark Stryker points out in that last piece (fifty-some years after his parents apparently sold his naming rights to Elmore Leonard), obstacles still remain before the deal is finalized. But if it proceeds as structured, the Detroit Institute of Arts stands to pull off the world’s first legal, mass art heist - to the public’s benefit. In negotiating terms, $100M for ownership of the entire D.I.A. collection would qualify as the type of absurd lowball offer pawn shops make to degenerate gamblers.

Consider that a quick and dirty appraisal by Christie’s last July pegged the value of just 2,773 works in the collection acquired with city funds at somewhere between $454-867M. Now consider that the D.I.A.’s full collection totals… around 66,000 works. Obviously, not all of those are created equal from a value standpoint, but in the opinion of some of the world’s leading valuation specialists, the museum potentially has the opportunity to pay $100M for a collection where a mere 4.2% of the assets could be worth as much as $867M.

For more context, remember that the “rediscovered” Leonardo painting Salvator Mundi sold privately last year for over $75M on its own, and that last fall Francis Bacon’s three-panel portrait of Lucian Freud sold at Christie’s London for $142.4M. For a total close to halfway between those two price points, the city of Detroit is selling an entire museum collection back to its caretakers, and thus, the public.

Of course, there are some wrinkles to framing the discussion this way. Every appraisal from an auction house should be treated with some level of skepticism, as I argued in the second half of my Salvator Mundi piece last week. And many of the un-appraised works were either gifted to the D.I.A. or acquired with funds donated to them by sources other than the city, meaning that they should have been safe from any clawback attempts anyway. But having been through an art world bankruptcy case, I can tell you that there are no guarantees of what might happen once avaricious creditors get inside the hen house. For $100M, the museum is not only acquiring the works purchased with city funding, it’s also paying a one-time-only protection fee for all 66,000 of its assets, at about a rate equivalent to the fabled $2 insurance on rental cars. Well worth it to keep those works permanently safe and forever viewable to the world at large.

Again, given the political labyrinth that any municipal bankruptcy case of this scale is, it’s still too soon to consider the grand bargain a done deal. But in a market where big money and financial innovation have tended to vacuum great art out of the public sphere and into private cloisters, it’s refreshing to see the general populace in position to win one for once - especially at such a bargain rate.