There's Deep... And Then There's Deep

I still owe you all the conclusion to my Average Is Over series, but I couldn’t let auction week in New York pass without saying a little something about the feeding frenzy.

In the course of reading recaps of the various sales and other goings-on about town the past several days, I encountered this quote from Michael McGinnis, the CEO of Phillips, on their Thursday night post-war and contemporary sale (via Katya Kazakina of Bloomberg):

“The bidding was much more vigorous than it’s been in a while. It means it’s a really deep market.”

From one perspective, McGinnis is on target. Per Forbes’s latest accounting, our planet now sustains more billionaires (1,645) than at any time in history. They outnumber at least 24 of the 25 most endangered animal species. And the latest barrage of auction results suggests those billionaires and other ultra-high net worth individuals made their presence felt in the art market again. Christie’s post-war and contemporary evening sale sucked in $745M, the house’s priciest auction in history by non-inflation adjusted dollars. Thirty percent of its buyers were new clients, and only four of the 72 lots offered went unsold. (All according to Carol Vogel at the NYT.)

Consistent with recent history, Sotheby’s did well in a vacuum but came up lame in comparison to its rival, bringing in $364M but seeing only 67 of its 79 lots sold per Gallerist. (The total was $16M shy of Sotheby’s one-night record last year.) Even Phillips - always a distant third to its big brothers - still managed to at least land on the prepared runway by selling 37 of its 46 lots for a total of $132M, above its low estimate of $124.6M for the sale as a whole.

I could go on, but I’d rather try to spoon a Komodo dragon than spend the rest of the morning throwing auction results at you. The point is, this week again highlighted that the super-rich are buying faster and more and at higher price points than pretty much ever, and if you want to uncover signs that the market is contracting in either value or plutocratic popularity, well, get a back hoe and clear your schedule for a while, because it’s going to take some serious digging.

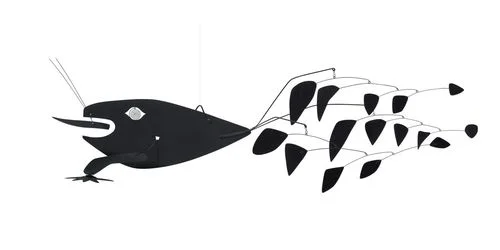

From another point of view, though, one could argue that McGinnis’s description of a “really deep market” has never been more laughable. It all depends on your definition of “deep.” I couldn’t help thinking back to something else I’d read from Kazakina not long ago, in the lead-up to the squall of cash that buried New York’s auction rooms this week. Her preview of some of the banner pieces up for grabs this sales cycle included a telling quote from Laura Paulson, Christie’s chairman and international director of postwar and contemporary art. In reference to Alexander Calder’s seven and a half foot mobile sculpture Poisson Volant (“Flying Fish”), which Christie’s presented at an estimate of $9-12M, Paulson explained that she was bullish on the piece because…

“We’ve had strong Asian interest… Fish is a symbol of good health and good fortune in China, of prosperity.”

Paulson’s confidence was well founded. The Calder crashed through its estimate like Chris Farley through an SNL coffee table, with the hammer cracking at $23M and the final total (with premiums included) settling at $25.9M. As Kazakina reported on the day, the winning bidder in the room was Xin Li, deputy chairman of Christie’s Asia, acting on behalf of an unknown client, whom I think it’s fair to assume was probably East Asian.

So on the one hand, this auction cycle was a reminder that we are now living in an art market being consistently and rapidly grown in value by an expanding network of ultra-high net worth buyers. But on the other hand, it also reinforced that those buyers are stampeding one another for artwork in more conspicuously consumptive fashion than ever. An Alexander Calder can shatter its price ceiling not because of the maker, the quality, or the art historical significance, but rather because China’s mega-rich think it would be cool to have a good luck charm that doubles as a billboard for net worth. Alex Israel, whose first non-MFA solo exhibition happened a mere three years ago, saw his first auctioned work go for over $1M at the Christie’s / Loic Gouzer red band auction If I Live I’ll See You Tuesday, andThursday night’s Phillips sale apparently featured Leo Dicaprio and his advisers - Gouzer and dealer-turned-convicted-felon Helly Nahmad - bidding on a Jean Dubuffet by pounding on the glass of their skybox with their fists like they were re-enacting the climactic church scene in The Graduate.

So there’s deep… and then there’s deep. Auction week demonstrated that the art market may be one, but it’s not the other. We can argue about whether that’s good, bad, or inconsequential. But there’s no point in denying anymore that it simply is. And that context is worth keeping in mind whenever you hear gallerists, dealers, or auction house CEOs tongue-kissing the state of the industry in a public forum, whether it’s in recaps of this week or further ahead in these complicated, frothy boom times.