Last week on Twitter my adrenaline level spiked when I encountered a link to SF-based Gray Area (no relation) and their Cultural Incubator. I’ve long wondered about whether there’s an opportunity for an artistic equivalent to venture-backed tech incubator/accelerator programs like Y Combinator and Techstars, so I was immediately intrigued by the notion that someone had pursued the model in the arts and culture realm–and if possible, I wanted to be a part of it.

Before we go on, a little background for the uninitiated. "Incubator" and “accelerator” are often used as synonyms in discussions of a certain class of tech program designed to cultivate startup concepts into viable companies. The basic idea is to provide seed funding and guidance at square one so that each project can grow strong and pay off for its early stage investors.

Read More

On Monday, Sotheby’s and eBay formally announced a new online partnership designed to simultaneously broaden Sotheby’s customer base and polish eBay’s image in the realm of high-end retail. Set to roll out progressively over the course of the next year, the union will begin with eBay’s hosting live streaming of Sotheby’s New York auctions in 18 unspecified sales categories–a feature that will eventually expand to include sales at the house’s other worldwide locations. The partnership’s other key component will be a set of exclusive Sotheby’s online auctions which, like the streaming service, will be hosted on a specially branded, now-under-construction subsection of eBay’s main site.

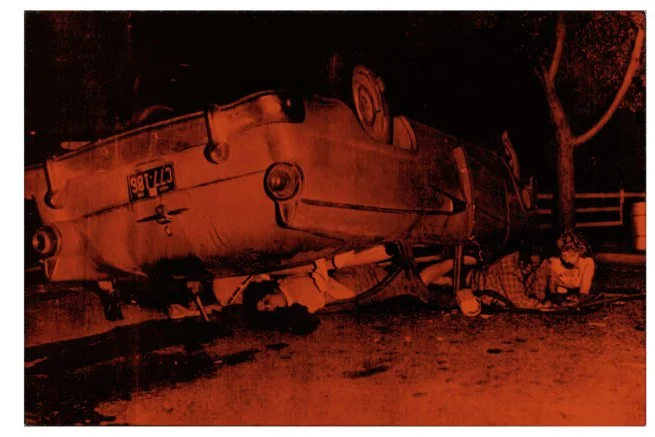

The relationship is in fact the sequel to an earlier affair between the two entities in 2002. That original union was more Fatal Attraction than From Here to Eternity. Despite being planned as a three-year partnership, heavy losses resulted in the joint venture’s going the way of the bunny after its first year. Nevertheless, twelve years of growth in the online fine art and luxury goods sales space has convinced the star-crossed lovers to try again.

Read More

Previously: Part I | Part II | Part III | Part IV | Part V | Part VI

I devoted the last installment of this series to playing Darwin with the physical gallery ecosystem, speculating on which tier of the market natural selection would favor as digital sales become a dominant force in the art industry. My conclusion was that the blue chip branded galleries would be the sole survivors–partially because existing evidence suggests that both the mid-size physical gallery and the mid-market art it concentrates on have been evaporating for years, and partially because the makers’ emporiums threaten to hunt the low end physical gallery into extinction.

However, the elite physical galleries that emerge from the reckoning will only do so by adapting. That will mean adding an online retail platform as a complement to their physical exhibition programming. The question at the heart of today’s post is what that online platform will be.

Read More

Previously: Part I | Part II | Part III | Part IV | Part V

Without replaying every point I’ve made to get here, I left off the last installment of this series by suggesting that the growing presence of digital sales will leave artists with two main outlets to sell their work in the future. One is what I dubbed “makers’ emporiums,” or major centralized online marketplaces (such as Saatchi Art) in which artists are empowered to connect directly with collectors. The caveat in this arrangement is the breadth of the emporiums - thousands of competing artists sortable with one flick of a touchscreen - and consequentially, a competition-driven contraction of profit margins over the long term. In short, more people than ever will be able to make money selling their work this way, but the amount of money per sale will be lower on average than in the past.

If I’m right about all that, then what does the alternative choice look like?

Read More

Thanks to some recent conversations I’ve had and some reading I’ve been catching up on lately, auction houses have been on my mind the past couple of days. While I’ve definitely alluded to what a bad look I think they are for collectors before, I feel compelled to be VVS diamond-clear about the topic this morning.

When it comes to art collecting, think of the major auction houses as four-star Vegas casinos. They’re big. They’re lavish. They’re loud. They’re packed with gamblers. And they’re engineered to herd their clientele into making the worst possible financial decisions at all times for their own benefit. The house always wins.

Read More

From Andrew Goldman’s recent profile of Colen:

Of course, Colen is preoccupied not just with the issue of staying power but also with that of legacy—a frequent topic of conversation in his circle of artist friends. “We all love to look at old Artforums and be like, ‘Who the fuck are these people?’” he says. “There’s a hundred ads in every issue from 1985, and there’s, like, three names you know. Is it different now?” Colen pauses to contemplate the heaviness of his own question. In one important way, he says, it’s very different: “Back then, there definitely weren’t 25-year-olds selling at auction for $300,000. To see how artists fizzle away after people have invested that much money in them will be interesting, I think.”

I may not be much of a believer in Colen’s work, but instead of taking time out to knock his hustle, I want to focus on how absolutely right he is about the points above.

Read More

Previously: Part I | Part II | Part III | Part IV

In the last installment, I discussed how, in an online-centered art market, branding will be at least as valuable as it is today, if not more so. The reason? The tyranny of options. With so much artwork so readily available via any device with a network connection, art buyers will crave signals of quality more than ever. And while I’m sure that a handful of artists will find ways to blaze their own independent path through this terrain, I believe that the rest of their colleagues will ultimately rely on one of two general outlets to sell their work, each with its own distinct pros and cons.

Read More

In the summer of 2003, I was one of nine interns in the Education department of The Cloisters. My primary job while there was to lead tours of the museum’s collection and gardens for packs of kids in New York-area summer camps, youth groups, and school programs. If you think Medieval art is musty and static, I assure you that the excitement level spikes when you know that at any moment during a walkthrough a couple of nine year-olds jacked up on Mountain Dew and Pixy Stix may start drop-kicking each other within inches of a 12th century wooden altarpiece. The Middle Ages come alive quickly in that context. (Also, the art is legitimately great.)

However, every Monday, when both The Cloisters and the Met’s main location were closed to the public, all of the interns in all of the museum’s departments engaged in some kind of planned, behind the scenes educational activity. The most sanctified of these events was a Q+A with the Met’s then-Director, Philippe de Montebello. The bulk of the session consisted of Montebello’s discussing a broad range of topics with another high-ranking executive or curator: museum practice in general, the Met in particular, his own journey to the Director’s throne, and a variety of other subjects that, admittedly, I’ve mostly forgotten.

Read More

Since I discussed the likely skill sets of successful future gallerists in Part I, the career prospects for those who don’t fit the profile in Part II, and the physical landscape of the gallerists who are left in Part III, in this installment I want to make some projections about market share and participation in an era of machine-assisted art sales. It leads us to perhaps the clearest manifestation of the “average is over” ethos yet.

While I believe the group I’ve labeled Leo Castelli type gallerists - those who excel in developing and supporting artists rather than hard-selling product - will be the most valued in future generations, the rise of online art sales and tandem decline in the number of physical gallery spaces nevertheless mean that the barriers to entry in the field will be at an all-time low. That raises a meaningful question: Even if the Leo Castelli types dominate the tangible gallery scene, will their dominance extend to the online marketplace of the future, as well?

Read More

How Grayson Earle’s Ai Weiwei Whoops! reflects today’s art world

Image credit: Grayson Earle.

Excited to say that clicking through the title of this post will take you to a piece I wrote for Kill Screen, the website and quarterly magazine on arts and culture via videogames, or as The New Yorker once described them, “the McSweeney’s of interactive media.” In it, I argue that the online game Ai Weiwei Whoops!, created by digital artist Grayson Earle after the infamous Ai Weiwei vase-smashing incident at Miami’s Perez Art Museum in February, unwittingly simulates today’s art market (you know, the one full of pre-selling, COINs, and record prices at branded auctions). Thanks to Kill Screen and especially my editor, Clayton Purdhom, for helping me to improve it and for giving it a home. Hopefully it’s the first of many more pieces I can actually link outward to from the blog.