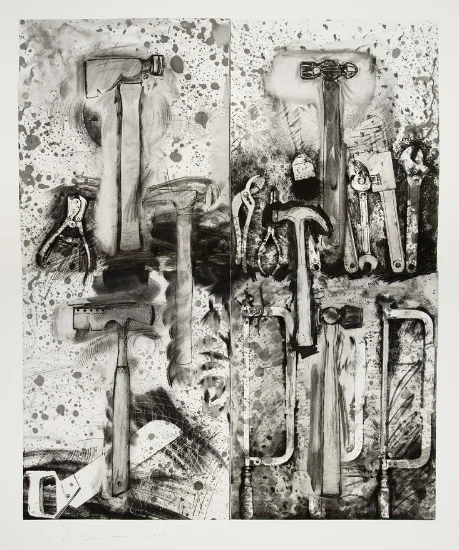

Market Monday: Hammer Time

For readers who don't already know, this year I've been writing a weekly email newsletter in addition to my standalone blog posts. The newsletter––which you can sign up for here––recaps major business developments in the art market over the previous seven days, with one or two sentences of commentary on each story from yours truly.

I haven't done a hall-of-fame job of publicizing the newsletter to date, and the discrepancy between the blog's page view numbers and The Gray Market Weekly's subscriber list reflects as much. So to try to muscle up both arms of the project, I've decided to start posting about half of each newsletter here on the blog every Monday morning. Newsletter subscribers, on the other hand, will still receive the full package every Sunday evening. So if you like the abbreviated version, sign up for the expanded one.

Every newsletter has a specific theme, and in honor of the start of the fall auction extravaganza last week, "Hammer Time" seemed like a good one for the Gray Market Weekly #42. So...

Let's begin in the obvious place: Sotheby's evening sale dedicated to the choicest lots from former head honcho A. Alfred Taubman's collection disappointed by amassing only $377M, including the sizable added bump of buyers' premiums––a hair over the low estimate of $374.8M for hammer prices alone (i.e. buyer's premiums excluded). Additional Taubman lots scraped together another $42.7M in a separate day sale Thursday, bringing the overall total to roughly $420M. Unfortunately, that's still $80M shy of the $500M Sotheby's guaranteed to the Taubman foundation regardless of results in the sales room. Two future auctions will give the house a chance to cover their bet, but at this point, I think the optics are already a dumpster fire. Hope you're all still short Sotheby's... [Bloomberg]

A few days before November's first gavel strike, Judith H. Dobrzynski swiveled a spotlight onto something that art world insiders have known for some time: Today's auctions are basically stage plays, with many of the final results predetermined through back room deals, in-house guarantees, and third party "risk-sharing" agreements. It's a reality that makes Sotheby's results with the Taubman collection all the more troubling, since rather than being victimized by an off-night from the bidding public, it implies the house was ill-prepared, ineffective, or both when it comes to the sector's very foundation in 2015. [The New York Times]

Katya Kazakina wrote a feature on how mega-collector Steven A. Cohen is "trading art like stocks," basically meaning that he views nothing in his collection as too sacred to be sold once it can yield a certain return on investment. Case in point, Cohen purportedly consigned the works featured on the covers of both Sotheby's and Christie's Postwar & Contemporary evening sales this week: a huge Warhol "Mao" portrait and a yellow egg-shaped Fontana painting, respectively. Kazakina wasn't able to discern what Cohen paid for either piece, as both transactions were private. But she notes that, at over $40M, the Warhol's estimate is now "40 times its last auction price 19 years ago." I think it's safe to assume that the Fontana, estimated at over $25M, is returning an equally mouthwatering multiple––and that, as a result, Cohen is proving that the best art investment play has always been to buy and hold blue chip names until they hit eight or nine figures, not pump and dump emerging artists who almost inevitably collapse before they hit seven. [Bloomberg]

Finally, Cait Munro covered the controversial saga of French artist Alexandre Ouairy, who has spent more than a decade building a successful career in China.... under the manufactured identity of a Chinese native with the alias Tao Hongjing. Allegedly, Ouairy finally decided to pull back the curtain because he feels that both the strength of his collector base and the current state of Sino-western cultural relations will make the truth a non-issue. But as valuable as a compelling artistic narrative is, can it backfire if pushed too far? Ouairy may just have given us all an opportunity to find out... [artnet News]

That's all for this week's sampler. See you back here next time, when the gavels are (temporarily) done falling.