Is Deaccessioning the Devil?: Part 2

In Part 1 last week, I offered up two scenarios in which a defender of deaccessioning could try to claim the incentives for her chosen tactic made sense. The first involved selling off assets that were secretly toxic - in effect, a kind of insider trading. The second involved selling off a surplus of a single artist in order to diversify the museum’s collection. The former situation was highly improbable, bordering on impossible; the latter ricocheted unintended negative consequences back onto the museum.

I want to spend this second installment digging into why deaccessioning makes little sense from the standpoint of art economics, mainly on the basis of market value. To do that, we need to dissect the particularities of the Dia scandal. One artist and one work in particular provide the clearest view.

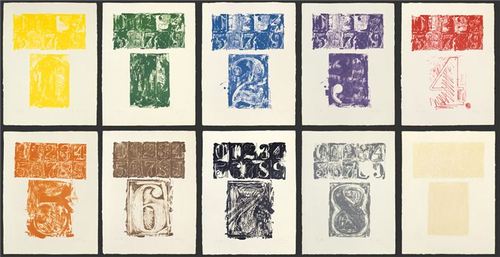

While then-Director Philippe Vergne peddled the “deaccession to diversify” narrative with the ten John Chamberlain works auctioned off, he could not make a similar case for the entire raft of artworks consigned to Sotheby’s. Among them were Dia’s entire holdings of the blue chip painter Cy Twombly. Best known for monumental canvases animated by childlike scribbles and rough textual scrawls reminiscent of hurried graffiti, Twombly pieces comprised 14 of the 27 assets deaccessioned under Vergne’s guidance, including the seminal drawing suite Poems to the Sea (1959).

Poems to the Sea was estimated by Sotheby’s at a value of $6-8MM. Counting the buyer’s premium (usually 10-12% of the hammer price for a sale north of $2MM), it eventually sold for $21,669,000. Now, this figure does not necessarily tell us the net profit to Dia. Auction houses generally collect a seller’s commission for their services. That commission normally falls somewhere between 2-5% of the hammer price, though sweetheart deals where the figure tunnels lower - or disappears completely - certainly exist. Let’s assume that Sotheby’s was generous with both clients in the deal, setting the buyer’s premium at 10% and the seller’s commission at 2%. The results would break out as follows:

Sales price with buyer’s premium = $21,669,000

Buyer’s premium = $1,969,910

Hammer price = $19,699,090

Seller’s commission = $393,982

Dia’s net proceeds = $19,305,109

The auction result for Poems to the Sea looks like a spectacular financial windfall for Dia on those terms alone. But it looks even better if we try to estimate their original cost for the piece. Perusing the auction record informs us that the foundation originally acquired Poems in 1980. The outside world will never know what the work’s sales price was in that transaction, but the rampant growth of the contemporary art market makes certain that it was orders of magnitude lower than the winning bid at Sotheby’s in 2013. I would be surprised if the 1980 figure passed $200,000, with a more likely figure being $100,000-150,000 (none of these adjusted for inflation). And even those lower numbers could be too rich.

But if I’m in the proverbial ballpark, it would mean that to acquire the Twombly suite in 1980, Dia may have paid somewhere between one-quarter to one-half of just their seller’s commission to Sotheby’s in 2013. It’s even possible that they paid nothing at all for Poems to the Sea. The provenance detailed on Sotheby’s listing does not state whether the work’s previous owner, The Lone Star Foundation, sold or gifted it to Dia - only that it last changed hands thirty-three years prior to the auction. Either way, though, the difference on Dia’s take-home wealth looks to be basically negligible - a couple hundred thousand dollars out of nineteen million.

But was deaccessioning the drawings an efficient use of assets in the grander context? Twombly’s status in the pantheon of post-war artists is secure, so this is clearly not a case of his work being secretly wired to detonate when the market wises up. Both Sotheby’s estimate of the work’s value and its multiples-higher sales price also seem to validate the lofty adjectives associated with Poems to the Sea in the links I’ve included in this discussion - “masterwork,” “one of his most important [pieces],” et al. Together, these statements basically send a Hellfire missile into Vergne’s notion of deaccessioning as “pruning.” The Twombly suite was about as far from dead weight as possible.

That makes his statement dishonest, but honesty is not a currency I’m interested in. The real problem is that it means deaccessioning the Twombly work qualifies as a misread of the market - or at least a correct read used to draw the wrong conclusion. Available evidence suggests that the auction sector of the contemporary art market has been rising steadily since at least 2011 - and I would argue that that’s a conservative assessment. The data we have suggests that ascension will continue unless some unexpected catastrophe plows through a worm hole a la 2008. Beyond general market conditions, Twombly’s stature as an artist, and the quality of Poems to the Sea in particular, strengthen the case that this asset was nowhere near its peak in the fall of 2013.

Why does that matter? Because it means that, as a value play, Vergne deaccessioned the works too soon to maximize their return. Yes, Dia did well from a financial standpoint. But if Vergne had waited, it appears highly likely that he and his institution could have done even better. I would suggest that if you’re willing to take the public body blow associated with the decision to deaccession, you should at least try to maximize your profits in the process.

The reason Vergne didn’t appears to be tied to the second downfall of this particular transaction. You may recall that the reason Dia wanted to deaccession part of its holdings was to bankroll another, even larger acquisition of thirty works then on long-term loan. Although the subsequent acquisition is described by Dia as a “partial gift, partial purchase,” the deal sounds as if it was far more commerce than philanthropy. For one thing, Dia clearly needed to raise a substantial amount of funding to complete the transaction. Otherwise, they would not have deaccessioned assets of the quantity or quality they did. For another, time was clearly a factor. Vergne was quoted as saying “we [Dia] needed to meet some deadlines.” That comment reveals the deaccessioning as more of a fire sale than a market strategist would like.

It gets worse. To explain why, the discussion must circle back to time’s effect on the value of art assets. I’ve already pointed out that what made Poems to the Sea such a great value for Dia was that it was acquired more than thirty years ago, when the contemporary art market was a speck of its current self. If it resembles a cottage industry today (as my old boss claimed when I started as a gallery assistant in 2005), then in 1980 it was some kind of paleolithic cave bazaar.

Even if Dia didn’t sell as high as it could have on the deaccessioned pieces, it still sold relatively high. But far more important was the fact that they were selling assets they’d bought very, very low. The problem is that the state of the contemporary art market today - the very thing that allowed Dia to sell (pretty) high on what they deaccessioned - elevated the prices of the replacement works to an all-time altitude, too. The thirty works Dia acquired after the auction were all from established blue chip artists, as well. (Ironically, one of them was John Chamberlain, one of the very artists deaccessioned because Dia had ostensibly over-collected his work.) In other words, they sold high just to turn around and buy nearly as high. Even accounting for the “partial gift” aspect of the new deal, compare the cost of the new acquisitions to what Dia paid years, even decades, in the past for the freshly deaccessioned works, and the foundation stood to receive staggeringly less value per dollar on the new acquisitions than on what it had just sold off.

In a vacuum, the strict value play would have been for Dia to use the resulting funds from the Sotheby’s sale to acquire works by mid-career or emerging artists - assets whose value, if the stars aligned, stood to streak onward and upward over the next thirty-three years in the same way that Poems to the Sea had. But this was not Vergne’s goal. Instead, as he stated in the press release, it was to “[honor] Dia’s relationship with a group of works and artists who have shaped [the foundation’s] identity and mission.” Unfortunately, I have no doubt that Dia paid dearly for that privilege. The end result is that, to accomplish his aim, Vergne greenlit a strategy that was doubly inefficient. It not only soiled the institution’s reputation, but ignored the cold economics of the market, too. For MOCA’s sake, I hope he doesn’t repeat history by sliding on his gardening gloves again - or that if he does, he at least manages to “prune” in savvier fashion than he did last year at Dia.